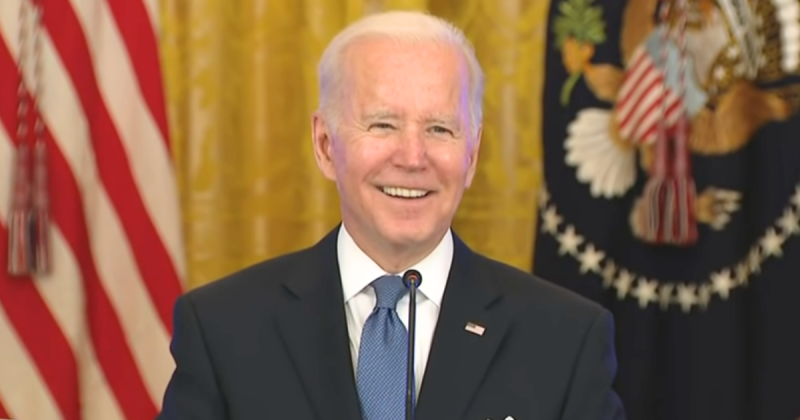

Former President Joe Biden could qualify for a historically high taxpayer-funded pension, according to a new analysis.

Experts say that combining benefits from the Former Presidents Act and the federal Civil Service Retirement System could bring his annual payout to around $417,000—far above the typical range for former presidents and most federal retirees, placing him among the highest federally funded retirees in modern U.S. history.

The National Taxpayers Union Foundation (NTUF) notes that Biden’s decades-long federal career—including service as a U.S. senator, vice president and president—allows him to “stack” multiple retirement entitlements.

While most former presidents receive pensions in the $200,000–$250,000 range, supplemental civil service benefits dramatically increase the total, making his projected payout unusually high.

Analysts say this combination is rare and has few precedents.

Under the Former Presidents Act, any former president is entitled to a lifetime pension, office space, staff and other allowances, according to Fox News.

Separately, the Civil Service Retirement System provides benefits to federal employees based on tenure and salary.

Biden’s long service in multiple high-level federal positions makes him eligible for both programs simultaneously, creating a rare combined benefit that amplifies his total retirement compensation.

Critics argue that the projected pension is extraordinary and raises equity concerns.

According to the NTUF report, very few Americans—even those with decades of federal employment—receive benefits approaching this level.

Analysts warn that overlapping federal programs can produce disproportionately high entitlements for officials who hold multiple high-level offices, even when all payments are fully legal.

Supporters counter that Biden’s pension is entirely lawful and reflects earned service rather than discretionary generosity.

Federal retirement formulas calculate benefits according to years served and salary, so his decades-long federal career naturally produces a higher payout.

Proponents emphasize that these programs are designed to reward long-term public service while following statutory rules for both legislative and executive branch positions.

The analysis also highlights implications for taxpayers.

While pensions are standard for federal employees, Biden’s potential payout is far higher than most retirees’ benefits, prompting discussion about sustainability and fairness in public retirement programs.

Some lawmakers and watchdog groups have called for reviewing formulas that allow overlapping entitlements, suggesting reforms to prevent unusually large benefits for select officials in the future.

Biden will not begin receiving the pension immediately; formal retirement procedures must be completed first.

Still, the case illustrates how multiple federal retirement programs can intersect, producing historically large payouts without any changes to current law.

Experts say the situation underscores the complexity of federal retirement policy and the need for transparency in publicly funded compensation.

The debate surrounding Biden’s pension has reignited discussions on transparency, fiscal responsibility and fairness in government retirement systems.

While entirely legal, the combined benefits have drawn scrutiny, prompting broader questions about how U.S. federal programs reward long-term service, the scale of taxpayer-funded pensions and whether reforms are necessary to ensure equity for average Americans.